Market Research: How Does Rednote See Africa?

- michael5923

- Jul 31, 2025

- 5 min read

Looking at RedNote viewership related to Africa, we've decided to put together an overview of where Africa's brand power among China's wealthiest and most influential consumers lies.

We follow the African Union’s regional designations: West Africa, East Africa, Central Africa, and Southern Africa, running keyword searches on our RedNote analytics platform for each country included under the four regional designations.

For the purposes of this report, Northern Africa is excluded from this dataset, as the tourism industry often treats it as a distinct cultural and travel destination separate from what is often referred to as Sub-Saharan Africa.

So what does the data tell us?

🏅 Eastern Africa dominates RedNote’s Africa-related content with a staggering 1.56 trillion total views; an overwhelming majority by any metric.

🥈 Far behind in second place is Southern Africa, with 160.5 million views, representing only about a tenth of Eastern Africa’s total.

🥉 Next is Western Africa, generating 72.5 million views, while Central Africa draws the smallest footprint, with just 93,963 total views.

Perhaps this is hardly surprising, given the cluster of tourism powerhouses in the Eastern Africa designation: Kenya, Tanzania, Mauritius, Madagascar, Uganda, Rwanda, Ethiopia and more. Still, this report looks to zoom in on what performs best in Eastern Africa not as a criticism of other African regional players; quite the opposite – we aim to highlight what the Chinese traveler to Africa enjoys most, so that competitors can rise in the African tourism space.

Eastern Africa, A Tourism Powerhouse on RedNote

Eastern Africa’s commanding lead on RedNote - with 1.56 trillion total views - can largely be attributed to the standout performance of a handful of strong tourism brands within the region.

📍 Kenya Tourism leads the pack with just under 481 million views, followed closely by Tanzania Tourism at 346 million views.

Other notable players include:

Mauritius Tourism – 121 million views

Madagascar Tourism – 53.4 million views

Rwanda Tourism – 42.2 million views

Ethiopia Tourism – 41.1 million views

Zambia Tourism – 28.2 million views

Uganda Tourism – 23 million views

Seychelles Tourism – 21.1 million views

Zimbabwe Tourism – 13.8 million views

Malawi Tourism – 3.5 million views

South Sudan Tourism – 3 million views

Comoros Islands – 1.5 million views

Burundi – 901,000 views

Together, these destinations form the backbone of Eastern Africa’s digital tourism presence on RedNote.

🔍 Top Experiences Driving Views

Certain iconic experiences also play a central role in driving interest:

Kenya Safari – 53.7 million views

Whale Watching in Madagascar – 42.9 million views

Whale Watching in Mauritius – 27.8 million views

Tanzania Safari – 26.3 million views

Kenya Shooting Range – 19.4 million views

Underwater Falls in Mauritius – 16.9 million views

One particularly interesting trend: while the Great Migration spans both Kenya and Tanzania, RedNote audiences associate it most strongly with Kenya alone, which draws 11.6 million views — compared to just 1.5 million for content tagging both countries, and only 516,000 views when tagged solely to Tanzania.

📍 Eastern Africa's Top Points of Interest: What RedNote Audiences Are Watching

Beyond national tourism brands and general experiences, specific destinations, hotels and landmarks within Eastern Africa are driving significant attention on RedNote. These micro-level data points help illustrate where audience curiosity and digital engagement are most concentrated.

Top Locations by Views:

Four Seasons Hotel, Seychelles – 319,000 views

Mahé, Seychelles – 242,000 views

Amboseli, Kenya – 240,000 views

Singita, Tanzania – 150,000 views

Praslin, Seychelles – 112,000 views

Akagera National Park Safari, Rwanda – 111,000 views

The strong showing from Seychelles - appearing three times in the top six - is evidence once more of long-haul Chinese travelers' love of high-end, island-based, luxury or scenic travel content. Meanwhile, Amboseli and Akagera represent classic safari and wildlife draws, though notably, their view counts still trail behind more leisure-oriented coastal destinations.

Southern Africa, A Region of Contrasts in Visibility

While Southern Africa ranks second in total RedNote views across Sub-Saharan Africa, the gap between it and Eastern Africa is vast: 160.5 million total views compared to Eastern Africa’s 1.56 trillion.

📍 Within the region, South Africa overwhelmingly leads with 119.997 million views, making up nearly three-quarters of the region’s visibility. It's followed by:

Namibia Tourism – 31.8 million views

Botswana Tourism – 4.9 million views

Lesotho – 522,000 views

Top Experiences: Penguins, Trees, and Surprises

The specific experiences drawing attention on RedNote in Southern Africa reveal some unexpected trends:

South African Penguins – 381,000 views

Namibian Quiver Tree – 45,700 views

Chobe River (Botswana) – 26,000 views

Table Mountain – 20,000 views

Sun City – 15,000 views

South African Hunting – 4,700 views

South African Camping – 4,700 views and 1,000 views (appearing in two separate content clusters)

South African Safari – Surprisingly low at just 1,600 views

Despite South Africa’s dominant presence in the region, traditional flagship experiences like safari are not resonating on RedNote at the same level as one might expect. In contrast, niche or unexpected content - like penguins and unique landscapes - appears to generate more traction.

Part 3: Western Africa: A Region with Limited Visibility

Western Africa ranks third in total RedNote views across Sub-Saharan Africa, with 72.5 million views, but this number is concentrated heavily in a single country and reflects a general lack of tourism content coverage across the region.

📍 Nigeria stands out as the clear leader with 64.1 million views, accounting for the overwhelming majority of regional interest. The rest of the region sees far more modest numbers:

Guinea – 6 million views

Gambia – 1.5 million views

Ghana – 38,000 views

Cape Verde – 274 views

Top Experiences and Destinations

When it comes to specific places or attractions:

Lagos, Nigeria – 533,000 views

Gorée Island (Slave Island), Senegal – 10,000 views

These numbers highlight the underrepresentation of West African tourism narratives on RedNote. Despite the region's deep cultural, historical, and ecological richness, it remains largely absent from the platform’s dominant visual and storytelling trends.

Part 4: Central Africa: The Least Represented Region on RedNote

Of all the Sub-Saharan regions, Central Africa has the smallest digital footprint on RedNote, with a total view count of just 93,963 — a striking contrast to the trillions of views Eastern Africa receives.

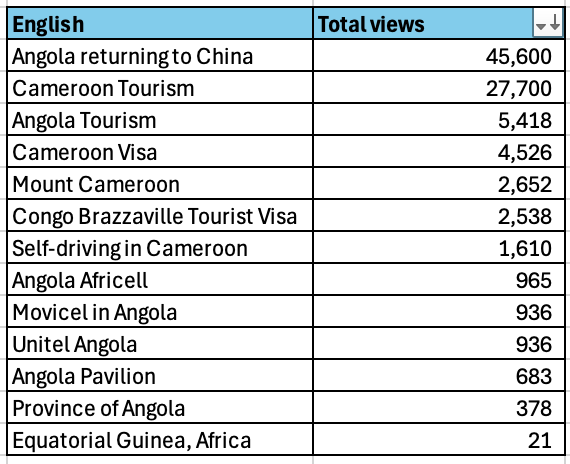

📍 What little visibility the region does have is scattered across a handful of tags, mostly centered on Angola and Cameroon:

"Angola returning to China" – 45,000 views

Cameroon Tourism – 27,000 views

Angola Tourism – 5,400 views

Cameroon Visa – 4,500 views

Experiences and Destinations

Only two specific experience-related tags emerge from the data:

Mount Cameroon – 2,600 views

Self-driving in Cameroon – 1,600 views

Central Africa’s near-invisibility on RedNote reflects a larger issue of content absence rather than a lack of tourism potential. The stories, landscapes, and cultural experiences of this region are simply not making their way onto major platforms, creating a critical blind spot in digital tourism narratives.

To conclude: What can we learn from East Africa?

Eastern Africa’s dominance on RedNote, with 1.56 trillion views, is more than just a story of viral content. It’s the product of long-standing political, business, and infrastructure ties with China, a welcoming visa environment, and a strong presence of Chinese enterprises on the ground. The region also boasts a cluster of well-differentiated tourism IP, from the Serengeti and the Great Migration, to Mauritius, Madagascar and the Seychelles’ luxury islands, that together create a critical mass of content and interest.

In contrast, Southern Africa, led by South Africa’s 119.9 million views, has seen less historical engagement with China, has faced ongoing visa frictions prior to TTOS, and has focused more on European and North American markets. Safety concerns and several high-profile incidents involving Chinese tourists, including robberies and hijackings, have also dampened momentum.

Meanwhile, Western and Central Africa remain largely underdeveloped in the Chinese digital tourism space. The content gaps reflect deeper issues: limited productization of tourism experiences, a lack of China-facing infrastructure and partnerships, and budding digital storytelling ecosystems. Yet these regions hold tremendous untapped potential, with rich cultural heritage and distinct natural environments that could, with strategic investment, become the next frontier of African tourism engagement in China.

Comments